Saudi Arabia has seen significant development since the launch of the ‘Vision 2030’ program in 2016, with the business environment being transformed and new sectors being created. The government has launched mega projects such as NEOM and the Red Sea, in line with its commitment to diversify the Kingdom’s economy away from its dependence on the oil sector. Saudi Arabia’s non-oil sector accounted for over 50% of GDP for the first time in 2023, with its share rising from 47.4% in 2015 to 51.7% that year.

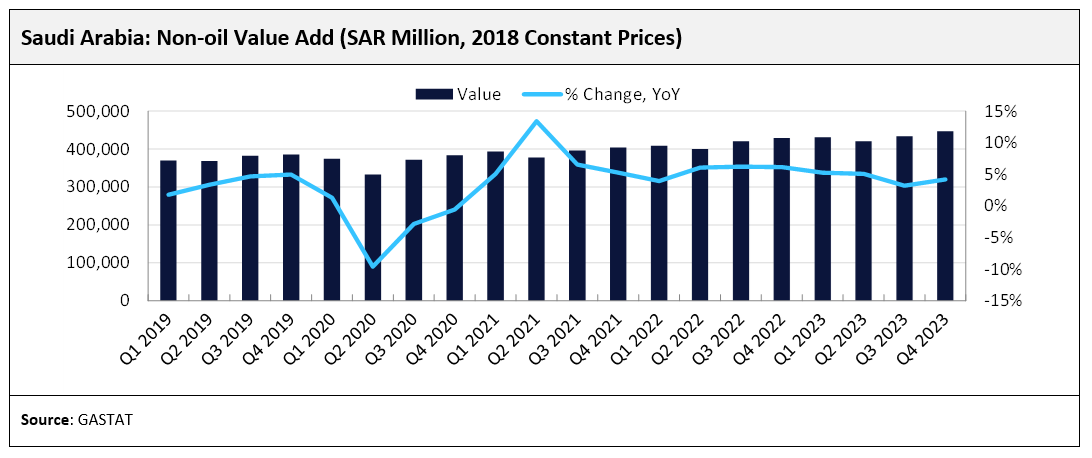

Non-oil activity recorded growth through 2023, with the Kingdom’s non-oil GDP (measured in 2018 chain-linked measures) rising by 4.2% year-on-year (YoY) in Q4 2023, according to the General Authority for Statistics (GASTAT); this was preceded by YoY growths of 3.2% in Q3 and 5.1% in Q2 2023. In 2023, non-oil value added rose by 4.4%, moderating slightly from the growth of 5.6% recorded in 2022. Mining activities did however remain weak in 2023, due to a decline in crude petroleum and natural gas mining. According to the GASTAT, the value add of mining and quarrying activities fell by 9.2% in 2023, owing to a 9.4% fall in crude petroleum and natural gas mining; in contrast, ‘other mining and quarrying’ activities rose by 5.7% in 2023.

The Saudi Arabian mining sector is expected to expand substantially in the coming years and play a crucial role in the Kingdom’s economic diversification efforts. According to the National Industrial and Mining Information Centre, the country’s mineral wealth is estimated to be SR9.4tn ($2.5tn), as of April 2024. Some of the recent discoveries that will support investment in the mining sector over the coming years include significant gold reserves along a 100km stretch south of the existing Mansourah-Massarah gold mine in the Al Khurmah governorate of the Makkah region. The state-owned mining company Saudi Arabian Mining Company (Ma’aden), which announced the find in December 2023, plans to intensify drilling activities around Mansourah-Massarah this year. This marks the first discovery as part of Ma’aden’s intensive exploration program that was launched in 2022, through which it aims to build a mineral production line, develop the Kingdom’s resource base, and support the government’s ambition to transform mining into the third pillar of the country’s economy. According to Ma’aden, at the end of 2023, the volume of gold reserves in Mansourah and Massarah was estimated to be seven million ounces, with an annual production capacity of 250,000oz.

The government is focused on accelerating exploration and mining activity and reducing the Kingdom’s dependency on oil revenue. In line with this effort, in January 2024, the Saudi Ministry of Industry and Mineral Resources signed memorandums of understanding (MOU) with four countries – Egypt, Morocco, the Democratic Republic of Congo, and Russia. These agreements will enable shared initiatives and knowledge transfer. The Ministry has also announced SR685m ($182m) in incentives, in cooperation with the Ministry of Investment, to support mineral exploration in the Kingdom and reduce the risks faced by exploration companies during their early stages. The Ministry of Industry and Mineral Resources issued 118 new industrial licences in February 2024, taking the total number of industrial licences granted since the start of the year to 270. By the end of February 2024, the Kingdom had 11,757 factories either operating or under construction, with 93 factories commencing production within the month.

The “Accelerated Exploration” initiative, which was launched by the Ministry of Industry and Mineral Resources in January 2022, is expected to further support the mining sector’s growth; the initiative aims to boost investment in the mining sector, accelerate the exploration process, and attract domestic and foreign investment. In early April 2024, the Ministry of Industry and Mineral Resources announced six new mining investment opportunities for local and international investors. The ministry has invited bids for new exploration licences for gold, copper, zinc, lead, and silver ores across the Kingdom, covering a total area of more than 940km². Investment opportunities include exploration licences in the “Makman Hijab” site in Riyadh, “Al-Mihah” site in Mecca, and “An-Nimas” and “Al-Hajirah” sites in Asir, among others.

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData